From Textiles to Turbines: Raymond’s Thrilling Entry into Aerospace

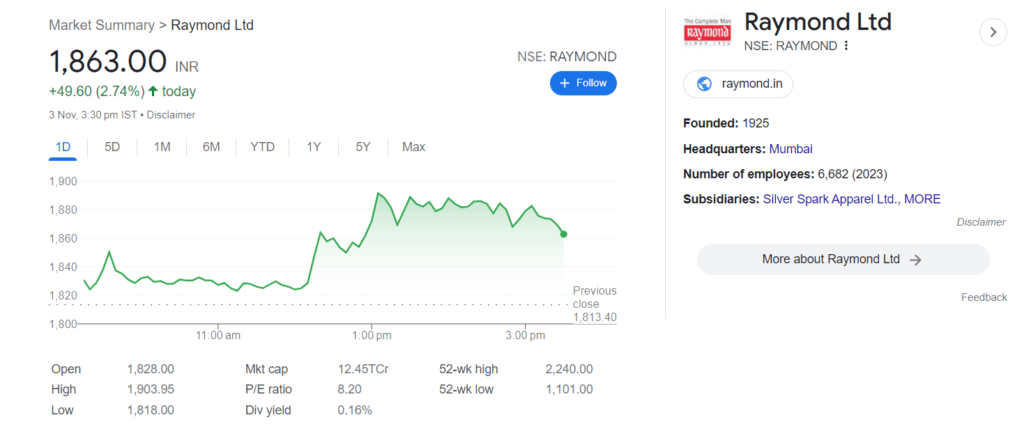

From Textiles to Turbines: Raymond’s Thrilling Entry into Aerospace beacause of this Raymond’s stock experienced a notable surge today, marking a 2.86% increase, as it climbed to Rs 1866 from its previous close of Rs 1814.65 on the BSE. This surge also had a positive impact on the company’s market capitalization, which saw an increase to Rs 12,355 crore on the Bombay Stock Exchange.

From a technical perspective, Raymond’s stock displayed a relative strength index (RSI) of 53.1. This RSI value suggests that the stock is currently neither overbought nor oversold, based on technical analysis. Furthermore, Raymond boasts a one-year beta of 0.9, indicative of relatively low volatility over the past year.

The trading day commenced on a positive note for Raymond, with its stock opening at Rs 11831.45. As the day progressed, shares of Raymond Ltd experienced a 3% surge during the afternoon trading session. This significant increase in stock value was driven by an exciting development within the Raymond Group – the acquisition of a substantial 59.25% stake in Maini Precision Products Limited (MPPL), valued at Rs 682 crore. This acquisition was financed through a combination of debt and internal accruals.

In addition to the aforementioned rise in stock value, the day saw 0.22 lakh shares of the company change hands, resulting in a total turnover of Rs 4.13 crore. The acquisition and the positive market response also led to the increase in the company’s market capitalization to Rs 12,355 crore on the BSE.

Raymond’s stock performance in recent times has been impressive, as it has consistently traded above various key moving averages. The stock has outperformed the 5-day, 10-day, 20-day, 30-day, 50-day, 100-day, 150-day, and 200-day moving averages. Over the course of a year, Raymond shares have gained a substantial 47.53%, and in 2023 alone, they have risen by an impressive 23.78%.

Raymond – Company Highlights

| Headquarters | Thane, India |

| Sector | Textiles, Engineering, Aviation & Real estate |

| Key people | Gautam Vijaypat Singhania (Chairman) |

| Type | Public |

| Founded | 1925 |

| Revenue | 83 Billion (Indian rupees) – 2023. |

| Website | www.raymond.in |

Raymond – About

The Raymond Group was founded in 1925 and is an extensive business that mostly operates in the clothing and textile sectors. It also works in both home and international markets in a variety of other industries, such as FMCG, real estate, engineering, and pharmaceuticals.

Raymond is known for giving its clients high-quality items for the past nine decades, and it has the backing of over a billion customers. “Raymond Group: Textiles to Turbines Journey“.

This acquisition marks a significant milestone for the Raymond Group, as it ventures into promising sectors such as aerospace, defense, and electric vehicle (EV) components. Raymond Group’s strategic move to acquire a majority stake in Maini Precision Products Limited aligns with its commitment to strengthening its existing engineering business, providing a complementary business presence in these sunrise sectors. The consolidated business is set to serve top global OEMs and Tier 1 manufacturers across aerospace, defense, automotive, and industrial domains, positioning Raymond as a key player in these industries.

Raymond Group’s Chairman, in discussing the acquisition, stated, “This acquisition is a strategic move to further strengthen Raymond’s existing engineering business with a complementing business that has presence in the sunrise sectors of aerospace, electric vehicles (EV) and defense. The consolidated business caters to the top Global OEMs and Tier 1 manufacturers across aerospace, defense, auto and industrial businesses.”

Through this acquisition, Raymond Group aims to consolidate its engineering businesses, including JK Files, RPAL, and MPPL, under a single entity. This strategic move is expected to bring about enhanced scale and size, further strengthening the group’s position in precision engineering products.

The acquisition process is planned to be executed through Ring Plus Aqua Limited (RPAL), a subsidiary of JK Files and Engineering Ltd (JK Files). As a result, Raymond Ltd. will hold a significant 66.3% stake in the “Newco,” which will be focused on precision engineering products. As of the fiscal year 2023, the proforma consolidated revenue of “Newco” is projected to reach Rs 1600 crore, with an estimated EBIDTA of Rs 220 crore. It’s important to note that the completion of this transaction is subject to the necessary regulatory approvals and is anticipated to be finalized during the current fiscal year.

In summary, Raymond’s stock experienced a substantial uptick in value following the announcement of its strategic acquisition of a majority stake in Maini Precision Products Limited. This move positions the Raymond Group as a significant player in aerospace, defense, and electric vehicle component sectors. The acquisition will result in the consolidation of various engineering businesses under a single entity, offering enhanced scale and size. With the transaction pending regulatory approvals, it is poised to be completed in the current fiscal year.

ALSO READ : What will be Trending in 2025

Significance of Raymond’s foray into aerospace, defense, and EV parts business

Raymond’s foray into the aerospace, defense, and EV parts business is significant for a number of reasons. First, it shows that the company is committed to diversifying its business and entering into high-growth sectors. This is important for Raymond’s long-term growth and profitability.

Second, Raymond’s acquisition of MPPL gives it access to a number of proprietary products and technologies in the aerospace, defense, and EV industries. This will enable Raymond to expand its product portfolio and enter new markets.

Third, Raymond’s foray into these sectors is a positive development for the Indian economy. It shows that Indian companies are increasingly investing in high-tech industries. This will help to create jobs and boost economic growth.

Challenges and opportunities ahead for Raymond

Raymond faces a number of challenges in its new venture. First, the aerospace, defense, and EV industries are highly competitive. Raymond will need to compete with established players in these industries.

Second, Raymond will need to invest heavily in research and development in order to stay ahead of the competition.

Third, Raymond will need to build a strong team of experienced engineers and technicians in order to manufacture high-precision components and systems for the aerospace, defense, and EV industries.

Despite these challenges, Raymond also has a number of opportunities in its new venture. First, the aerospace, defense, and EV industries are all expected to grow rapidly in the coming years. This will provide Raymond with a large and growing market for its products and services.

Second, Raymond’s strong brand name and reputation will help it to attract customers in these industries.

Third, Raymond’s financial strength will enable it to invest in research and development and build a strong team of engineers and technicians.

Overall, Raymond’s foray into the aerospace, defense, and EV parts business is a positive development for the company and the Indian economy. Raymond has a number of challenges ahead of it, but it also has a number of opportunities. With careful planning and execution, Raymond can succeed in its new venture.

In summary, the incredible journey of Raymond Group from textiles to aerospace turbines is a tale of creativity, determination, and the constant pursuit of perfection.

Their influence on the aerospace industry, both domestically and internationally, is proof of what can be accomplished with forward-thinking leadership and a dedication to pushing the envelope. They encourage people to dream large, adjust, and contribute to the constantly changing landscape of their various industries as they continue to create the future of aerospace.

—

**Suggested Headlines:**

1. Raymond’s Stock Surges 2.86% Following Strategic Acquisition in Aerospace and EV Sectors

2. Raymond Group Enters Sunrise Sectors with 59.25% Stake in Maini Precision Products

3. Precision Engineering Boosts Raymond’s Market Cap to Rs 12,355 Crore

4. Raymond’s Stock Soars as It Expands Presence in Aerospace, Defense, and EV Components

5. Consolidating Success: Raymond Group’s Acquisition Marks a New Era in Engineering Business

ALSO READ: What Technology is used in Pune Metro?

Q1. What is the story behind Raymond brand?

Ans. – In 1925, Raymond Limited was initially established as the Raymond Woolen Mill in the vicinity of Thane Creek. In 1944, Lala Kailashpat Singhania became the new owner of The Raymond Woolen Mill. They have subsequently been associated with style, grace, and uniqueness, as shown in their men’s fashion.

Q2. Who is the owner of Raymond clothing?

Ans. – Gautam Vijaypat Singhania (born 9 September 1965).

Q3. What are the achievements of Raymond company?

Ans. – The Raymond Vapi Plant has been awarded the 2013 National Energy Conservation Award’s Second Prize. Raymond is the top-ranked company among the ‘Textile and Garment’ category of Fortune magazine’s ‘Most Admired Companies in India 2013’.

Q4. What is the turnover of Raymond in 2023?

Ans. – Raymond India reported a revenue of over 83 billion Indian rupees in fiscal year 2023.

Q5. Who is the CEO of Raymond India?

Ans. – Gautam Singhania – Chairman and Managing Director – Raymond Limited.

Q6. What is the SLogan of Raymond ?

Ans. – Raymond’s had as their tagline, “The Guide to the Well-Dressed Male.” The advertisement featured stylish men with stylish women, together with every aspect of success, such as fancy automobiles, glamor, and glamour.

I am Swapnil Duphare , Owner of Website : HeliumMinings – I am Digital Marketer from last 6 Years and Write Blog Articles based on Helium Minings & Crypto currency Related Articles.

I am From Nashik, Maharashtra, India.

Also Check Website : SEOWIRES