How to Calculate Your Helium Taxes -HeliumMinings Blog

How to easily figure out your helium taxes, step by step :

Are you sick of feeling stressed out and confused about how to figure out your helium taxes?

Stop looking! In this step-by-step guide, we’ll take the mystery out of the process and give you all the tools and information you need to quickly figure out your helium tax.

Whether you’re a helium expert or just starting out, this blog post will help you understand the process, make it less scary, and make sure you never pay too much or miss out on any discounts.

So get a pen and paper because we’re going to dive into the interesting world of helium taxes.

A Quick Look at Taxes on Helium There are many things that can matter when it comes to taxes.

How to file your taxes for helium

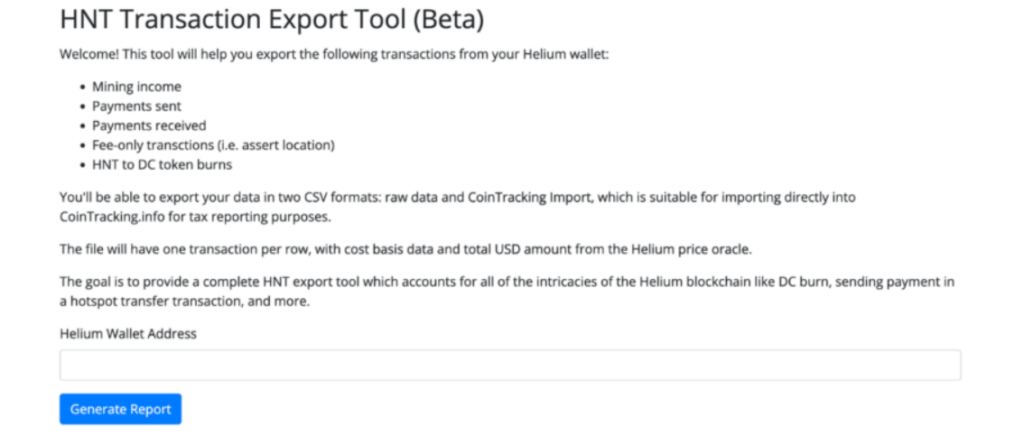

Have you made purchases from your wallet and invested in Helium? If so, you might have to figure out and file taxes for each Helium transaction. By using the procedures below, Coinpanda can assist you in determining the cryptocurrency tax on Helium:

Create a free account to safely and securely add your Helium addresses to Coinpanda.

Next, Coinpanda will import all of your Helium transactions.

Wait for Coinpanda to automatically compute capital gains on your transactions involving Helium.

Download your tax report for helium.

Before the deadline, submit your Helium tax returns.

What you will find in this guide is our current understanding of the process to file your Helium Mining income in the United States. It should also be noted that every country/jurisdiction has different laws and ways of treating mined cryptocurrency.

This post is for informational purposes only, please consult with a qualified tax professional before filing your Helium taxes.

The tax on helium can be hard to figure out, but we’re here to help.

In this blog post, we’ll show you how to easily figure out your helium taxes and tell you everything you need to know.

We’ll talk about things like what the tax rate is and how to figure out how much you owe. So, whether you own a business or are just a customer, this guide will help you learn about helium taxes and how they work.

What is a tax on helium?

Helium sales have to pay a tax. Taxes can be different from one country to the next, but they are usually a portion of the price.

How to Figure Out Your Taxes on Helium If you live in the United States, you need to know a few things to figure out your helium taxes.

First, the Federal Helium Program takes 10% of the price of all helium sold in the U.S.

The National Helium Reserve, which is in Amarillo, Texas, is run and kept in good shape with the money from this tax. Second, most states also add an extra tax to the price of helium when it is sold.

The amount of this tax changes from state to state, so you will need to check with your local government to find out what it is in your area.

To figure out how much you owe in helium taxes, just add the 10 percent federal tax to the state tax rate in your area.

If you live in a place where the sales tax on helium is 5%, for example, your total tax would be 15%. How to Figure Out Your Helium Taxes If you know how much helium you’ve used in the past year, it’s easy to figure out how much tax you owe.

Avoid Paying Extra Charges :

1. Find out how much tax your state or country charges. Helium taxes can be different depending on where you live, so it’s important to know the rate before you start doing math.

2. For helium, use a tax tool. There are many online tools that can help you figure out your taxes without having to guess. Just tell the tool how you want to use it, and it will do the rest.

3. Write down how much gas you use. It’s always a good idea to keep track of what you’ve done in case you get inspected.

This can help you get your tax bill lowered if it turns out you paid too much.

Don’t make these mistakes when figuring out your helium taxes: Helium taxes don’t have to be hard or take a lot of time to figure out. But when people figure out their taxes, they often make some common mistakes.

Avoid Making Silly Mistakes :

1. Not knowing how much tax to pay. Either the standard tax rate or the special event tax rate is used to figure out helium costs. Before you figure out your taxes, make sure you know which rate applies to your event.

2. Making a mistake when figuring out how many gas tanks are needed. To figure out how much tax you need to pay, you need to know exactly how many gas tanks you need for your event.

3. Not taking delivery costs into account. The total amount used to figure out how much tax is owed must include the cost of delivering gas tanks.

4. Doesn’t include all fees and taxes that may be added. In addition to the base tax rate, your event may have to pay other fees and costs. Make sure to include all fees when you figure out your taxes.

In the end, A key part of having a good business is knowing how to figure out your helium taxes. With the right information and help, it’s easy to figure out your helium taxes.

We hope that this step-by-step guide has helped you understand how to figure your helium taxes correctly so that you can make sure all of your financial records are up to date and follow local rules.

Also Read : Choosing the Perfect SenseCap Outdoor Helium Enclosure: Factors to Consider

I am Swapnil Duphare , Owner of Website : HeliumMinings – I am Digital Marketer from last 6 Years and Write Blog Articles based on Helium Minings & Crypto currency Related Articles.

I am From Nashik, Maharashtra, India.

Also Check Website : SEOWIRES